Single Window for

Motor Third Party Liability

We provide modernised and standardised third party insurance registration procedures on behalf of the Insurance Regulatory Authority.

BUREAU VERITAS - AN INDEPENDENT THIRD PARTY

We provide supervision and control of insurance policies underwriting and claims management by synchronising public and private databases, harmonising the data gathered and standardising processes.

The Single Window for Motor Third Party Liability is designed to support long-term reform. Depending on the circumstances, it may be operated under a concession, a joint venture or a public-private partnership. This permits the insurance regulator to benefit from the expertise and technology of the partner.

OUR APPROACH

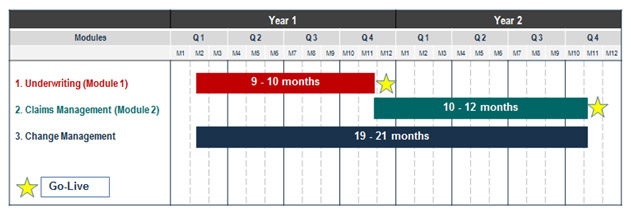

EXAMPLE OF TIMELINE

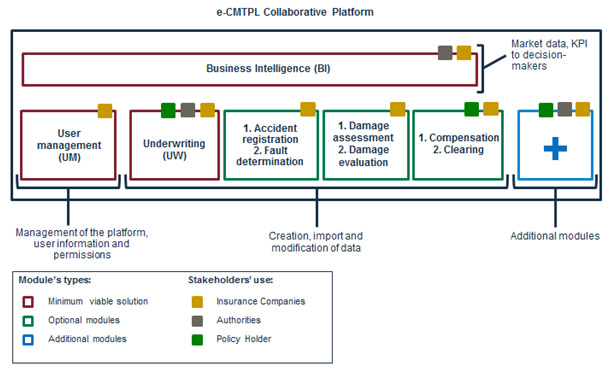

- Module 1 - Underwriting (User Management, Underwriting, Business Intelligence)

- Module 2 - Claims Management (Accident Registration /Fault Determination; Damage Assessment/evaluation; Compensation/clearing)

- Change Management (stakeholders’ training, technical preparation, consensus on reform)

KEY BENEFITS (ARMENIA BUSINESS CASE)

-

INSURED

Get insured in 2’40 (contract underwriting).

Fast and fair compensation based on market prices.

-

REGULATOR

Traceability of all actions by any user (agent, insurance company employee).

Synchronisation of all stakeholders’ databases connected to an e-CMTPL platform.

-

INSURANCE COMPANIES

Cost control

Reducing insurance companies’ costs (-15% of CMTPL market).

Cash management control

Traceability of all clients’ payments.

Traceability of all commissions by intermediaries.